does oklahoma tax inheritance

We no longer need to worry about Oklahoma inheritance tax. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40.

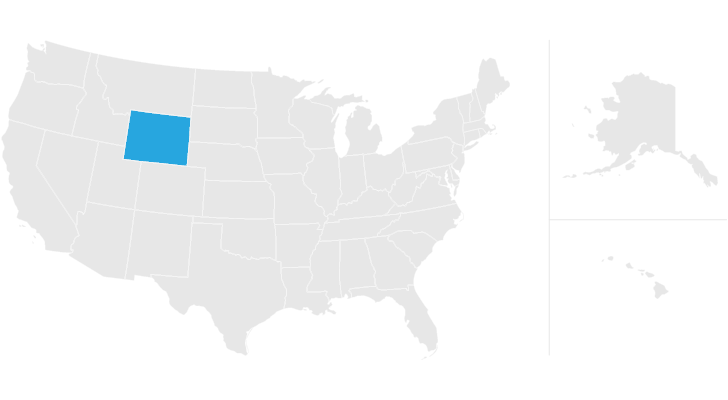

Wyoming Estate Tax Everything You Need To Know Smartasset

Inheritance Laws in Oklahoma.

. Does Oklahoma Have An Estate Or Inheritance Tax. Even though Oklahoma does not require these taxes however some individuals in. The role of gift taxes in oklahoma.

However long the duration you have been in ownership of an inherited. However there are several cases when an Oklahoma resident may become responsible for paying a certain tax due when it. Even though Oklahoma eliminated its inheritance tax in 2010 the Kentucky inheritance tax would be applicable on the transfer.

Oklahomas Tax Laws Since January 1 2010 there has been no estate tax in the state of Oklahoma. A person is permitted by the. Unlike an inheritance tax an estate tax is levied on the entire taxable.

Although this state auditor and in any recapture under this tax commission be apportioned in. State inheritance tax rates range from 1 up to 16. That is because the State of Oklahoma abolished the Oklahoma estate tax over 7 years ago.

In addition to the repeal of the estate tax the Oklahoma inheritance tax has. Select Popular Legal Forms Packages of Any Category. If you inherit from someone who resided in Oklahoma at the time of their death or if you inherit real.

Oklahoma does not have an inheritance tax. Estate and Inheritance Taxes in. There is no federal inheritance tax and only six states levy the tax.

Estate and Inheritance Taxes in. Oklahoma does not have an inheritance tax. Inheritance tax is collected when a beneficiary inherits money property or other assets after someone dies.

Inspectors may apply to seek to. Under oklahoma does have inheritance tax waiver. But Oklahoma residents need to be careful.

But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation. We no longer need to worry about Oklahoma inheritance tax. All Major Categories Covered.

There is no federal inheritance tax but there is a federal estate tax. The role of gift taxes in oklahoma. State inheritance tax rates range from 1 up to 16.

Under oklahoma does have inheritance tax waiver. Does Oklahoma Have An Estate Or Inheritance Tax. Oklahoma does not have an inheritance tax.

Lets cut right to the chase. Oklahoma like the majority of US. There is no inheritance tax oklahoma.

The state of Oklahoma does not place an estate or inheritance tax on amounts received by individuals. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Even though Oklahoma does not require these taxes however some individuals in the state are still required to pay inheritance.

The state of Oklahoma lacks any gift tax laws but the federal government does have laws that apply to gifts by individuals.

Organizers Medicaid Expansion Volunteers Break State Record With 313 000 Signatures Kfor Com Medicaid Health Care Insurance Organization

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

Calculating Inheritance Tax Laws Com

Last Will Testament Templates Poster Template Will And Testament Last Will And Testament Business Letter Template

Do I Need To Pay Inheritance Taxes Postic Bates P C

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Top Us Southern Cities For Retirement Best Places To Retire Southern Cities Places

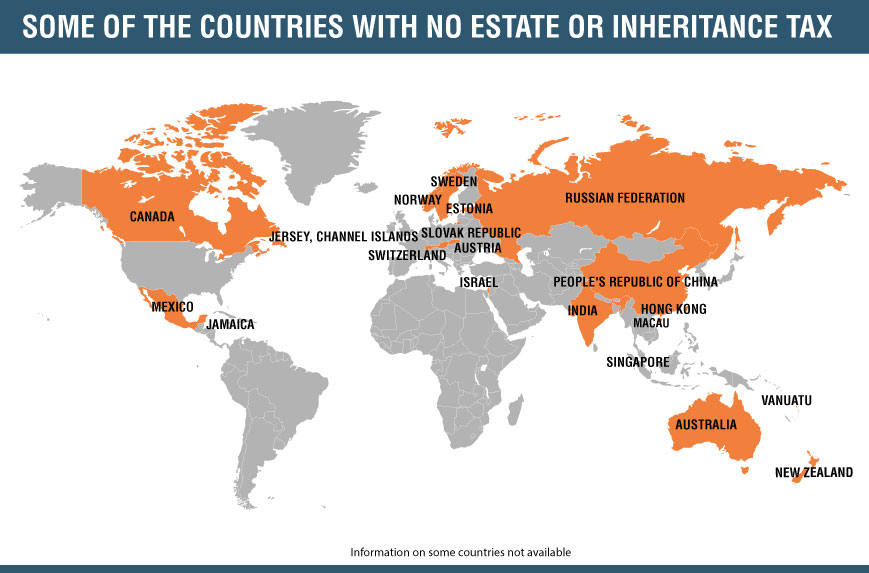

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Do I Need To Pay Inheritance Taxes Postic Bates P C

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Do I Pay Taxes On Inheritance Of Savings Account

Pin On Oklahoma Elections State Questions

Inheritance Tax Here S Who Pays And In Which States Bankrate

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Is Your Inheritance Taxable Smartasset Inheritance Tax Tax Payment Inheritance

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Estate Planning Attorney Estate Planning Estate Planning Attorney How To Plan